Ondo Finance Live

Nathan Allman 🌊 @nathanlallman

1/ Today we are excited to announce Ondo Finance. Ondo is a new primitive built to accelerate DeFi adoption among mainstream investors by enabling the granular exchange of risk.Fixed lending project Ondo is live with a guarded launch.

Ondo lets users pool assets in vaults that originate and manage risk-isolated loans backed by yield-generating tokens.

Lenders can access loans with fixed yields over fixed durations, meaning lenders will have forecastable yield and mitigated downside.

Currently, users can earn 10-50% APY from fixed yield vaults and earn up to 500% APY from variable yield vaults (excluding IL).

Sushiswap

Today in DeFi is sponsored by Sushiswap.

Sushiswap is a DeFi-Native DEX on Ethereum, Polygon, and Fantom, which features the best liquidity across many DeFi pairs such as YFI, SNX, and AAVE.

Besides its multi-chain Dex, Sushiswap also has Kashi gas-efficient lending markets for long-tail assets like UMA, Rune, or Chainlink.

Check out Sushiswap at Sushi.com, or try Kashi here.

Alpha Tiers Live

Alpha launched Alpha Tiers for Alpha stakers.

Benefits for high-tier stakers include higher protocol fees from Alpha products & selected Launchpad projects, Launchpad project tokens, and higher yields from higher leverage on Alpha Homora v2.

Binance Polygon Integration

Binance users can now deposit and withdraw MATIC directly on Polygon mainnet.

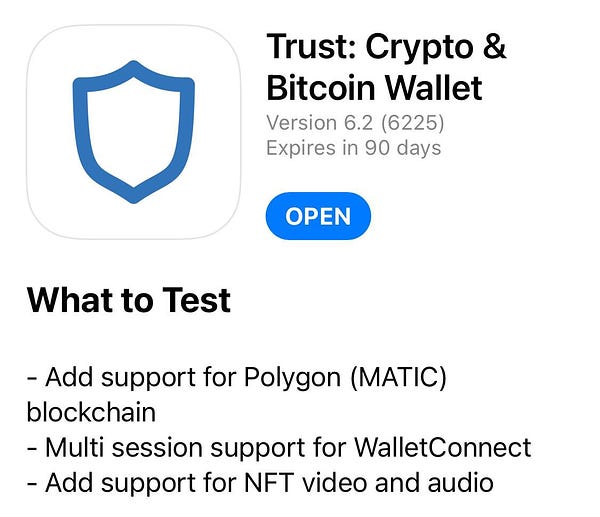

Trust Wallet Supports Polygon

Trust Wallet now supports Polygon for iOS users.

Follow @todayindefi to keep up with the latest DeFi news on Twitter.

Disclaimer: Projects or tokens mentioned in this newsletter are often experimental or unaudited. Do your own diligence before using or buying anything mentioned.

2 years ago

266

2 years ago

266