Product Launches 🚀

zkSync 2.0 Closed Alpha

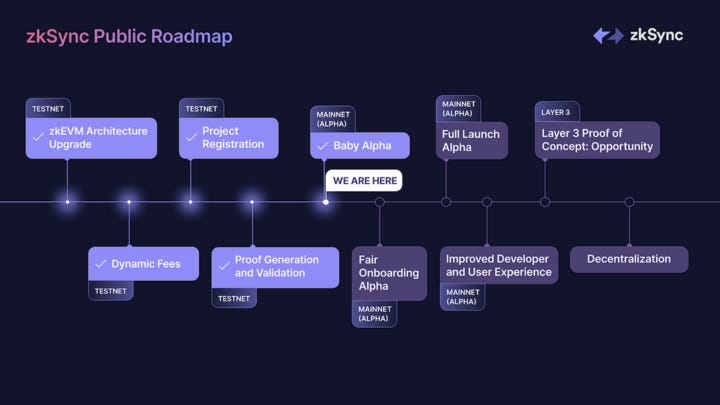

The rollout for zkSync 2.0 is phased into 3 stages. The Baby Alpha (stage 1) is now live which only the team can access, with stage 2 for external teams coming in Q4 and stage 3 for end users going live by the end of this year.

LlamaLend Live

Built by DeFiLlama, LlamaLend is an NFT lending protocol that has fixed interest rates and no price liquidations.

Agoric Mainnet & Inter IST Live

Cosmos-based L1 Agoric launches its mainnet, with Inter Protocol going live on Agoric with its flagship product IST - a fully collateralized stablecoin on Cosmos.

Integral TWAP Order on Arbitrum

Integral launches SIZE on Arbitrum, allowing users to execute TWAP orders with MEV protection and zero slippage (due to the use of a Uniswap oracle).

Spin Live on NEAR

NEAR-based DEX Spin launches perpetual trading with up to 10x leverage on its platform, with more order types and isolated margin support to come.

Aries Markets Live on Aptos

Lending protocol Aries Markets is now live on Aptos.

vFat Portfolio Manager

Farming tool provider vfat has launched vfat.io, a portfolio manager.

Vaults Soul-Bound Tokens

Interest rate swap protocol Voltz has launched Soul-bound tokens that let its community members who participate, govern, or trade on the protocol earn badges and “pointz”.

Project Updates 🚩

NEAR USN Winding Down

Decentral Bank DAO, the issuer of USN, announces it will gradually wind down the native stablecoin on the Near ecosystem.

The closure of USN is due to insufficient collateral, and the NEAR Foundation has allocated $40m for USN protection plan grants.

Lido Testing DVT

Lido is testing the integration of DVT (Distributed Validator Technology) with the SSV network and operators on Ethereum’s testnet.

DVT enables multiple Node Operators to run distributed validators, which DVT is crucial for Lido to enable solo stakers to participate in the protocol.

Kava 11 Live

Kava 11 went live on mainnet. The upgrade brings KAVA liquid staking, Kava yield aggregator, MetaMask support for all Kava txs, and protocol-owned liquidity.

Hegic Live on Arbitrum

After months of beta testing, Hegic Herge is now officially live on Arbitrum with audited contracts, revamped interface, and battle-tested architecture (HardCore) for p2p options trading.

Harmony x LayerZero

Harmony to partner with LayerZero to relaunch its bridge, and will also partner with Lossless to deploy a security infrastructure to prevent future attacks.

LooksRare Zero Royalties

LooksRare switches to optional royalties for NFT creators but allocates 25% of its 2% protocol fee to creators. This results in an effective 0.5% royalty fee on trades for all collections, which is a lot lower than most were previously seeing.

UXD Implements ALM

Solana stablecoin protocol UXD integrates Mercurial’s vault to implement its Asset Liability Management Module. The strategy will generate cash flow and the revenue will be used to buy back UXD’s protocol token UXP.

Telos Safe

Safe (fka. Gnosis Safe) went live on Telos L1 as Telos Safe, providing multi-sig service for securing transactions on Telos.

Governance Highlights 📝

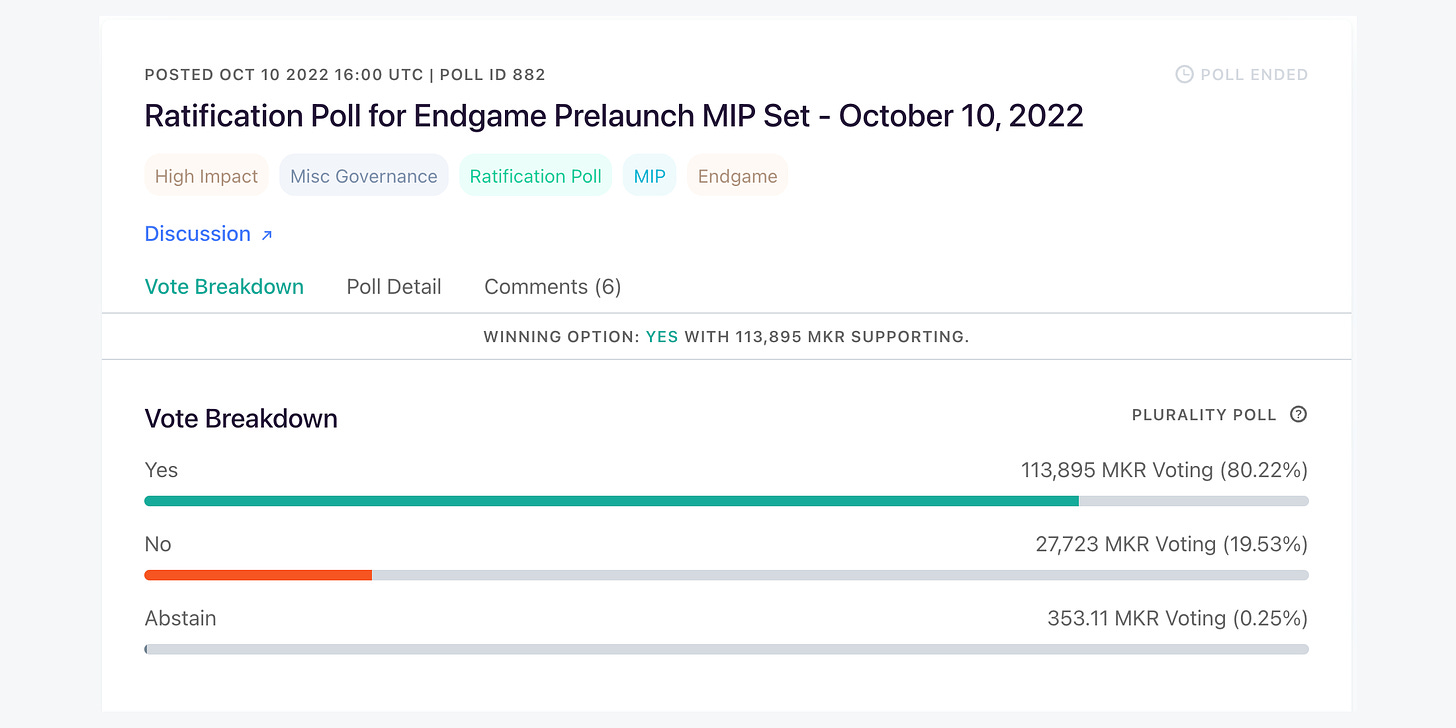

MakerDAO Endgame Plan Approved

MakerDAO Endgame, a proposal to decentralize MakerDAO assets by founder Rune Christiansen, has passed. Endgame is a structural change to not only MakerDAO assets and revenue model but also its governance structure.

Maker to Custody Vault with Coinbase

MakerDAO passed the poll to onboard 33% of the PSM’s USDC (~$1.6b) to Coinbase Prime, allowing Maker to participate in Coinbase’s Institutional Rewards Program.

In return, Maker will earn 1% APY on the first 100m and 0.1% more APY on each 100m USDC thereafter.

Sushi Legal Structure

The Sushi community passed the restructuring proposal to turn the DAO into three legal entities based in Panama and the Cayman Islands.

Paraswap PSP 2.0

Paraswap community proposed PSP 2.0, a tokenomics revamp that brings ve-model (sePSP) and staking to PSP, a fairdrop, reduced emissions, a new protocol fee-sharing system, and a boost for current stakers to migrate.

Hacks/Bugs/Issues 👾

QuickSwap Flash Loan Attack

QuickSwap is temporarily closing the Market.xyz lending market, in which the market funds were seeded by Qi DAO. An attacker conducted a flash loan attack by exploiting a Curve LP Oracle vulnerability and hacked away $220k from the market.

Upcoming ⏳

FTX Stablecoin

Centralized exchange FTX is reported to be working on its own stablecoin, likely to launch via partnerships.

Gains on Arbitrum

Polygon leveraged trading protocol Gains is having its contracts audited and will soon deploy to Arbitrum.

Aave on StarkNet

Aave <> Starknet Phase I has been finished and is ready to deploy after Aave community’s approval. The project is about bridging Aave v2 aTokens on Ethereum to/from StarkNet and Phase II will be following.

Today in DeFi Premium includes early looks at promising projects, yield farming tips, and proper research to help you get the most out of DeFi.

If you haven’t, subscribe today with Credit Card or Crypto (get discounts on quarterly or yearly subscriptions).

Last week we published the following features for our Premium Subscribers:

Premium Guides:

Intro to Fire Wallet Extension

1 year ago

236

1 year ago

236