Yearn veYFI Live

Yearn launches UI for users to stake YFI for veYFI. Previously, users can take part in governance using YFI, and going forward veYFI will be the only governance token on Yearn.

Signal Vote: Increase Sushi Kanpai Payout Ratio

The Sushiswap community is voting to produce a signal on whether to redirect 100% of the Sushi fees redirect to the Kanpai Treasury for 1-year.

Maple Loans Update

Auros, a borrower on Maple that was affected by the FTX bankruptcy, has made a mutual decision with underwriter M11 Credit to allow the loan to lapse to overdue. Based on the financial position of Auros, even without a successful restructure, they say they should be able to recover a large majority of the assets for liquidity providers.

CowSwap Limit Orders Live

DEX aggregator Cowswap now enables limit orders to traders.

zkLend Artemis Testnet Live

StarkNet-based lending protocol zkLend launches public testnet of Artemis, zkLend’s lending interface for traders to test out lending/borrowing on StarkNet.

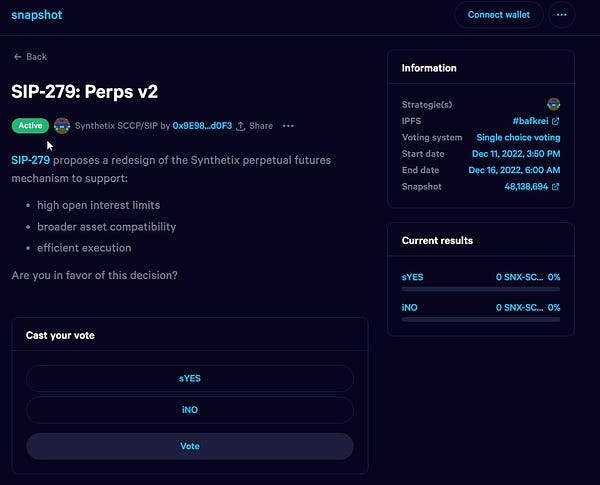

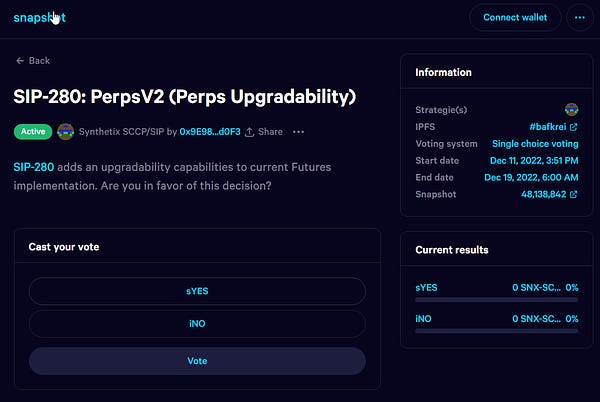

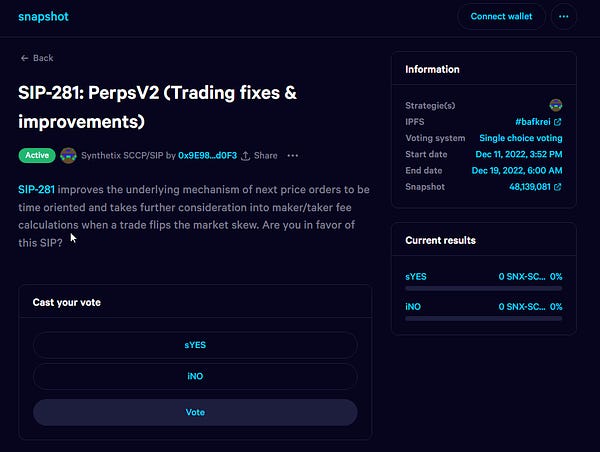

Vote: Synthetix Perps V2

The Synthetix community is running votes to launch Perps v2. V2 will bring improvements and new features such as Off-chain Oracles, Funding Rate adjustments, Price Impact based on skew, etc.

Hong Kong Stock Exchange to List Bitcoin, Ethereum ETF

The Securities and Futures Commission (SFC) of Hong Kong approved CSOP's application to list its Bitcoin and Ethereum Futures ETF on the HSE on Dec. 16.

1 year ago

235

1 year ago

235