Opium ETH Dump Protection

Opium now offers an insurance product for ETH price declines.

Bearish investors can buy the protection to mitigate potential losses while bullish investors can stake stablecoins into the pool, earn premiums from the buyers, and buy ETH at a cheap price when it drops.

The Dude Abides.

Sushiswap

Today in DeFi is sponsored by Sushiswap.

Sushiswap is a DeFi-Native DEX which features the best liquidity across many DeFi pairs such as YFI, SNX, and AAVE.

Sushiswap has recently launched Bentobox, gas-efficient lending platform for DeFi, as well as Kashi, a one-click margin-trading platform.

Check out Sushiswap at Sushi.com, or try the Bentobox/Kashi beta at staging.sushi.com

Furucombo on Polygon

Transaction batching tool Furucombo is now available on Polygon. Transaction cost is one of the biggest challenges with batching txes, so this should make Furucombo much nicer to use.

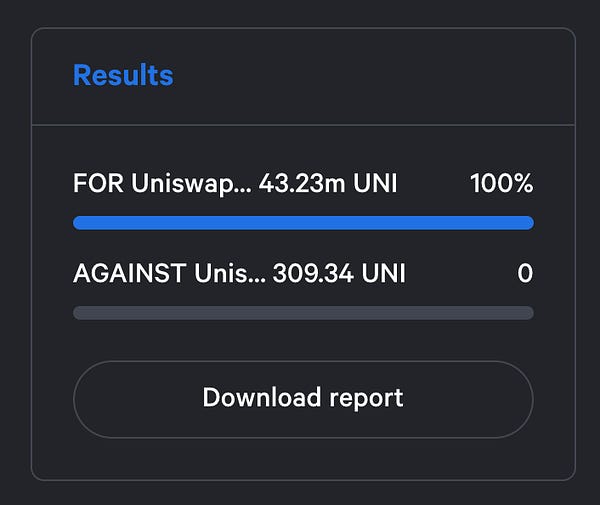

Archer TEV Vote

Archer is voting to launch a reward program to share TEV (Trader Extractable Value) profits with traders. Archer’s TEV back-running bots are already live on ArcherSwap, protecting traders from MEV and profiting miners, this will share those profits with traders.

ICYMI: Uniswap v3 on Arbitrum

Uniswap v3 is now on Arbitrum and the interface is also updated.

Andre previews new yield product

Yearn founder Andre showcased what he’s been building, using AAVE+YFI. This platform seemingly lets users capture the yield difference between Yearn Finance Vaults and Aave borrows.

Follow @todayindefi to keep up with the latest DeFi news on Twitter.

Disclaimer: Projects or tokens mentioned in this newsletter are often experimental or unaudited. Do your own diligence before using or buying anything mentioned.

2 years ago

358

2 years ago

358