Product Launches 🚀

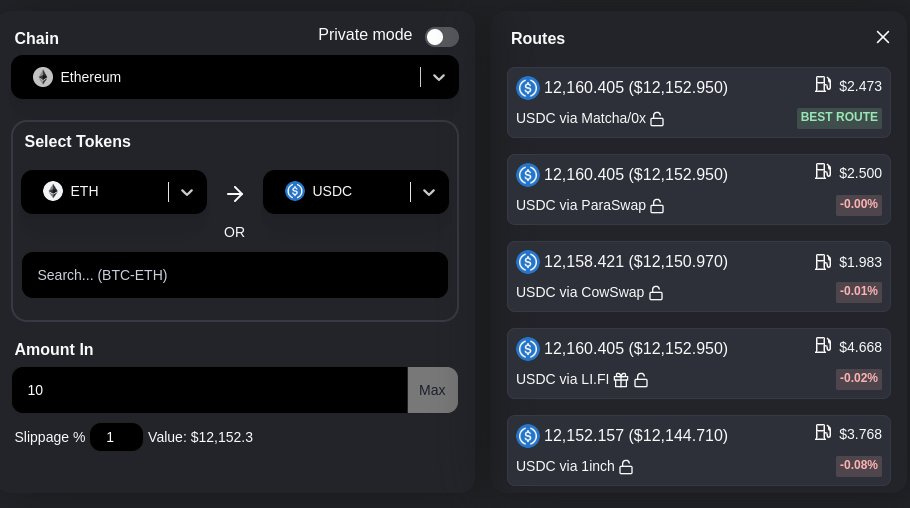

DeFi Llama LlamaSwap Live

Defi Llama launches a meta DEX aggregator - integrating 8 aggregators and supporting swaps across 22 chains.

gTrade Live on Arbitrum

Gains Network launches gTrade on Arbitrum, allowing users to leverage-trade cryptos, stocks, and forex using DAI.

Mean Finance Live on Ethereum

Previously on Polygon and L2s, DCA protocol Mean Finance is now available on Ethereum, offering DCA tools with MEV-protected & gasless swaps.

Insrt Finance Live

NFTfi yield protocol Insrt launches on Ethereum. The first deployed vault type is ShardVault, which allows users to take a directional bet that the price of a bluechip NFT collection goes up and farm yield passively.

Synquote Testnet on Arbitrum

Polygon-based Options trading platform Synquote launches testnet beta on Arbitrum.

Timeswap V2 Testnet Live

Polygon-based lending AMM Timeswap launches V2 testnet, allowing testers to compete on maximizing returns to win the prizes.

Project Updates 🚩

Gamma Strategies on Arbitrum

Uniswap V3 liquidity management protocol Gamma Strategies launches on Arbitrum, supporting new pairs for Arbitrum-based assets.

Sushi to Deprecate Kashi, MISO

Sushi CTO mentioned in a review thread that Sushi will deprecate its lending product Kashi and launchpad MISO due to the lack of resources to dedicate to the products.

Stacks BTC

Bitcoin L2 network Stacks announces sBTC, a two-way pegged BTC that works similarly to wBTC (wrapped Bitcoin) but without any custodian.

Governance Highlights 📝

Sushi New Tokenomics

Sushi CEO proposes new tokenomics, changes include LP fee share, xSushi rewards, token burns, liquidity lock, and emissions.

fSUSHI Proposal

OhGEez DAO proposes to introduce fSUSHI, a fixed-rate upfront yield strategy to bring additional yield to Sushi LPs. The proposal also requests a 500k SUSHI grant to support 1-year operations of OhGeezDAO and the Flashstke protocol.

BitDAO $100m Purchase Program

BitDAO community voted to spend $100m USDT from the treasury to buy back the BIT token.

Hacks/Issues 👾

Vader Shutting Down

Stablecoin protocol Vader announces the plan to shut down as the team found no notable breakthrough in the algorithmic stablecoin design that is capital efficient.

The Vader dApp will be available until June 2023 for redemptions.

Upcoming ⏳

Convex cvxCRV Update

Convex will enable several enhancements to cvxCRV staking, including additional incentives, adjustable rewards, and ETC-20 transferable staked cvxCRV.

Today in DeFi Premium includes early looks at promising projects, yield farming tips, and proper research to help you get the most out of DeFi.

If you haven’t, subscribe today with Credit Card or Crypto (get discounts on quarterly or yearly subscriptions).

Last week we published the following features for our Premium Subscribers:

Premium Guides:

Opyn Squeeth: Zen Bull Strategy

1 year ago

268

1 year ago

268