Last week Cozy Finance launched by Andre Cronje, Volmex launching volatility trading, and Pendle launching yield markets.

Product updates include Opium, which also launched insurance for real-world events, Rari launching yvToken pools, and Instadapp launching a governance token.

The Polygon ecosystem keeps growing as we saw many new projects launch there as well as existing projects expand onto the network, such as SynFutures and Ren’s Curve BTC pool.

And scarcely a week goes by without incident - three major hacks happened over the week, affecting Visor, IRON, and Alchemix.

Finally, Futureswap and Kyber gave sneak peaks of upcoming launches.

Sushiswap 🍣

Today in DeFi is sponsored by Sushiswap.

Sushiswap is a DeFi-Native, multi-chain DEX which features the best liquidity across many DeFi pairs such as YFI, SNX, and AAVE.

You can swap DeFi pairs at Sushiswap, earn yield by farming, earn yield by lending, stake SUSHI for more SUSHI, or margin trade on Kashi

Sushiswap has also recently launched Liquidity Mining on Polygon. Find out more.

Ethereum Launches ♢

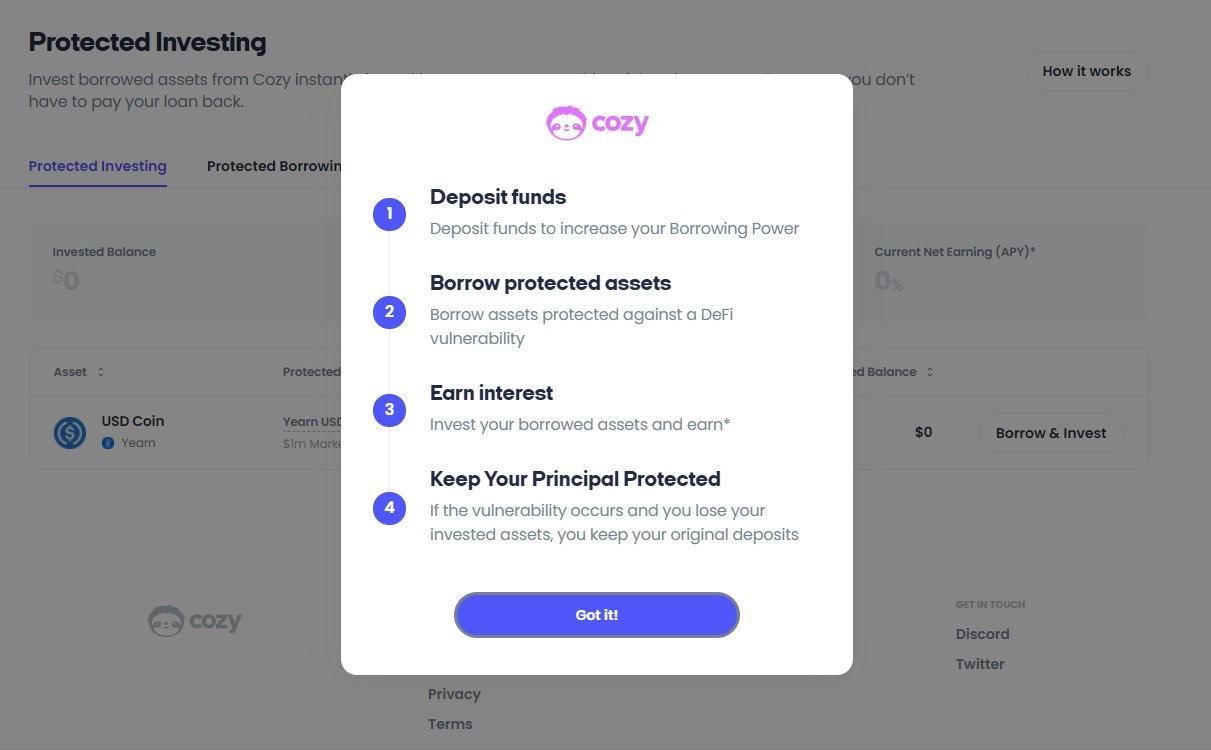

Cozy Finance

Yearn founder Andre launched a new protected investing product, which lets users earn yield in DeFi while being protected against exploits.

Opium Upgrade & SpaceX Insurance

Opium released a new version and launched an insurance product for SpaceX flights.

Rari yvToken Pools

Rari launched a set of Yearn vault token pools on their open-interest-rate platform Fuse.

Pendle Live

Pendle went live to enable trading tokenized future yield.

LP pools now hold more than $22M of liquidity, while implied yields on Yield Tokens are holding well at 13%.

Instadapp INST

Instadapp launched their governance token along with staking and LM program.

Ribbon Staking & LM Live

Structure products protocol Ribbon launched staking and LM program for users to earn RBN (a non-transferable token).

Unmarshal Multi-chain Explorer

Unmarshal launched xscan.io public beta, a multi-chain explorer for Ethereum, Polygon, and BSC.

ICYMI: Volmex V1

Volmex launched on mainnet to offer volatility index products and tradable volatility tokens.

Polygon Launches ♾

SynFutures Alpha

Futures exchange SynFutures launched closed alpha on Polygon, offering arbitrary assets & maturities, synthetic AMM, and automated liquidator.

Ren BTC Pool on Curve Polygon

Ren launched a stable renBTC/amWBTC pool on Curve Polygon, using AAVE to earn extra yields on WBTC.

Hack 👾

Visor Incident

An attacker hacked a Visor admin account and stole 500k in assets from LP positions. Visor later used treasury funds to cover and restore all user's positions.

IRON Bank Run

Iron Finnce suffered a bank run which caused the price of TITAN to drop to zero and also de-pegged its stablecoin IRON.

Alchemix Reverse-Rug

A mistake in the deployment of Alchemix’s alETH led to miscalculations about user debt, resulting in a 2,688 ETH shortfall for alETH backing.

Upcoming⏳

Futureswap Launching V3 on Arbitrum

Perpetual futures protocol Futureswap is launching V3 with a protocol redesign. V3 features more leverage & more assets, and will be on Arbitrum.

Kyber Launching DMM on Polygon

Kyber Network will deploy DMM on Polygon (June 30). The Kyber Rainmaker LM program is already live on both Ethereum and Polygon.

Follow @todayindefi to keep up with the latest DeFi news on Twitter.

Disclaimer: Projects or tokens mentioned in this newsletter are often experimental or unaudited. Do your own diligence before using or buying anything mentioned.

2 years ago

288

2 years ago

288