The food coin niche is a stale, oversaturated, and mostly rotten trend. BUT, I found nourishment in Pickle.Finance.

The PICKLE project offers “triple dip” interest, but at a higher risk. Its code has yet to be audited. It has some innovative ideas, an engaged community, cool memes, and a great locked value to market-cap ratio.

What is Pickle Finance?

Pickle.finance is a yield farming protocol that benefits defi. It helps stablecoins maintain their $1 pegs.

It does this by giving higher APY incentivization to stablecoin pools which are below their peg. This encourages users to migrate to the highest APY pools. It has a 1-click swap feature, allowing funds to easily shift between pools, saving on gas fees.

Important Links:

TwitterPicoPaperTelegramGlassnode Article 1Coinsweet Article 2With Pickle, users can triple dip in rewards, by first staking Uniswap LP tokens in pJars and Farms. Here’s how:

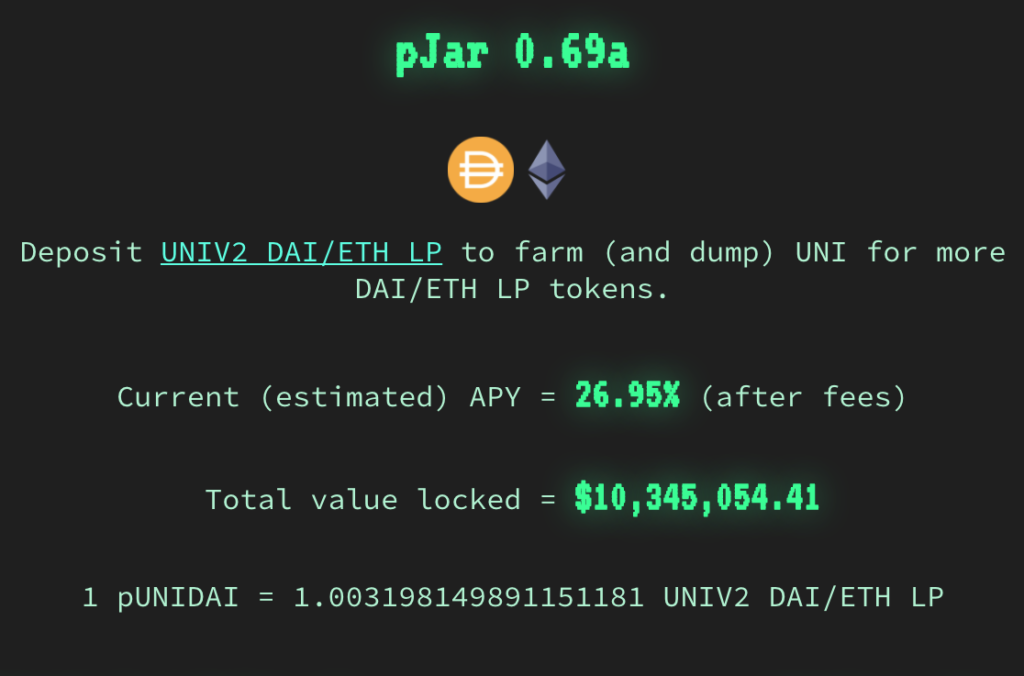

Users stake Uniswap pTokens to earn 26% APY (varies) in pJars (pJars are similar to yearn vaults). The pJar also compounds UNI rewards by automatically selling and re-investing it. You don’t have to pay gas fees to harvest/sell your UNI tokens.

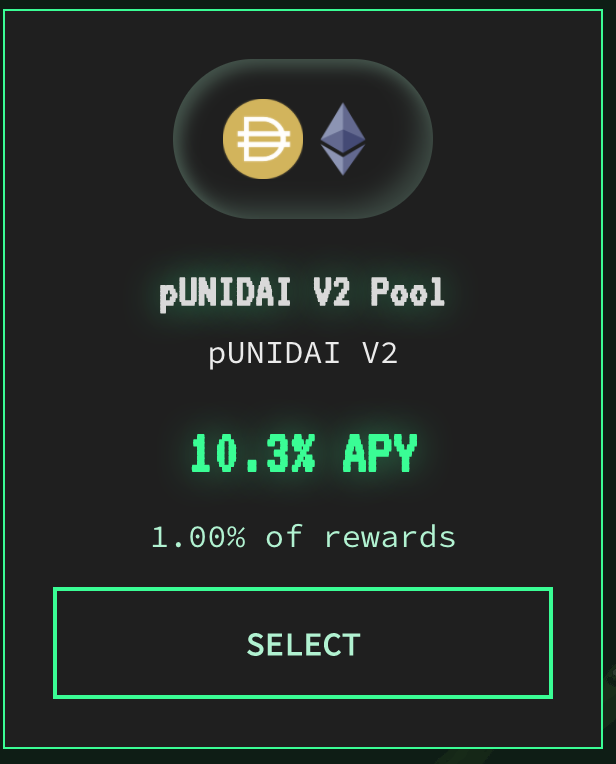

2. Next, they can stake pUNI pool tokens (from pJars) to earn an additional 10.3%. This allows them to earn interest, plus $PICKLE tokens. A new governance proposal (PIP-8) will allow users to stake $PICKLE to earn additional revenue as well!

Users can earn Triple dip rewards, while still earning LP rewards on Uniswap!

So, How is Interest Generated on Pickle.Finance?

Interest is earned in jars (like “vaults”) via strategies like arbitrage and flash loans. It works similarly to Yearn Finance.

Additionally, the pickle jar automatically sells and re-invests the farmed UNI tokens. The earnings are put into the pickle jar. This causes the pool to grow, and pTokens to gain value. There is a .5% fee to exit pools, which goes to buy/burn PICKLE tokens.

The PICKLE token

PICKLE had a fair token launch. The token is distributed through liquidity mining. Its supply is currently at 756,291. It has inflation, but the emission was just reduced. No money went to VCs, pre-mine, or an ICO. The devs take a percentage as a development fund. They also take 2% of all coins minted. Users can mine PICKLE by contributing liquidity, or purchasing it on Uniswap.

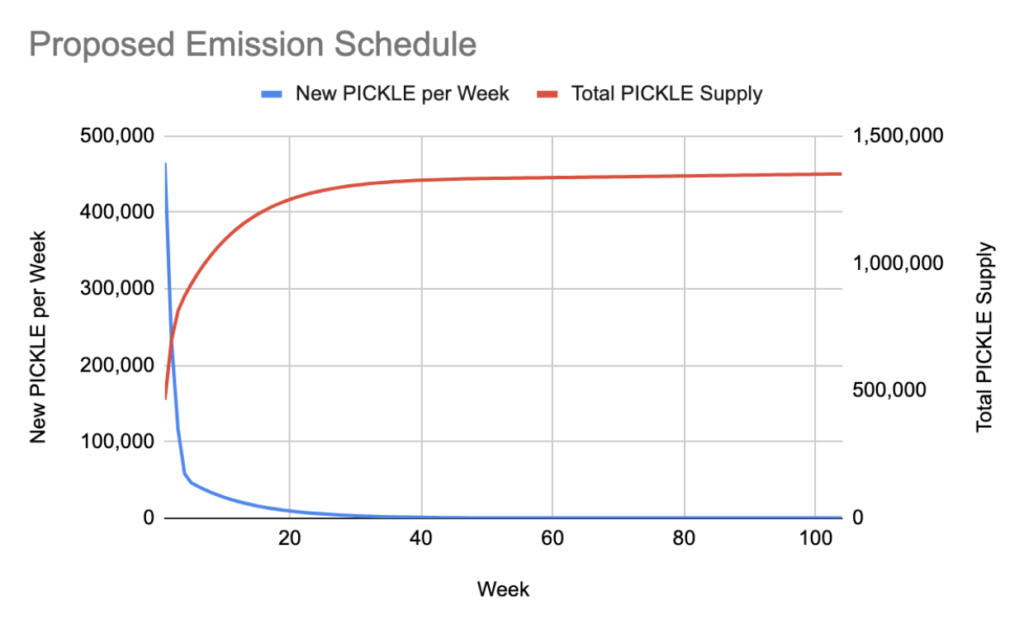

After a recent governance vote the supply is being distributed at only 1 PICKLE per block! They are even going to cap the inflation rate.

The proposal PIP-5 just passed. It will further reduce emissions to 1.5 million after 2 years. The token will be bought and burned, which could even make it deflationary. The funds to buy and burn PICKLE are generated from the withdrawal fees from pickle jars.

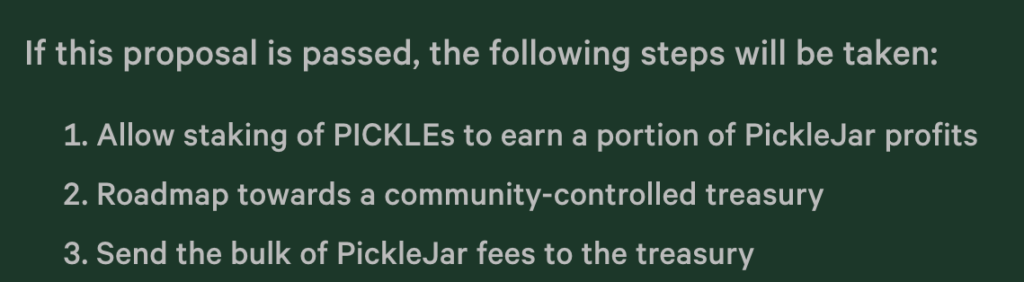

Proposal PIP-8 just passed. It incentivizes users to hold the PICKLE token. Users can stake it to earn a share of the jar profits. The “majority of withdrawal fees from the PickleJars would be diverted to the Treasury“.

Pickle’s Governance

The $PICKLE token allows users to participate in governance. Governance participants receive a 3% share in governance fee and 0.5% of withdrawal fees. View governance proposals here.

PICKLE has an active, engaged community. PICKLE uses quadratic voting, which was endorsed by Vitalik.

Introduction to quadratic voting / funding / attention payments.https://t.co/UyrV6FCmkC

— vitalik.eth (@VitalikButerin) December 8, 2019Are there Risks using Pickle.Finance?

The main risks of using Pickle.finance are smart contract failure, or hacking. The protocol hasn’t been audited for security flaws, but was constructed in a drag and drop way, from pre-written smart contracts. I personally do invest in higher risk projects, but i only use a small amount of funds that i have allocated for that.

Conclusion on Pickle. Finance

PICKLE brings innovation to yield farming. It helps maintain stablecoin pegs. It has an engaged community, which steers the project in the direction of higher value for $PICKLE token holders. If the community keeps the tokenomics in check, demand for $PICKLE will grow.

Unlike most food tokens, there is a utility for the $PICKLE governance token. It will soon generate rewards from a portion of pJar profits. Emissions will be reduced, to the point it might become deflationary. The $PICKLE token’s value should grow over time. Pickle delivers ripe APY returns, while most food tokens are just empty calories. Its low market-cap to value locked ratio makes it very attractive to investors.

If you liked this article, follow me @defipicks