Quick Take

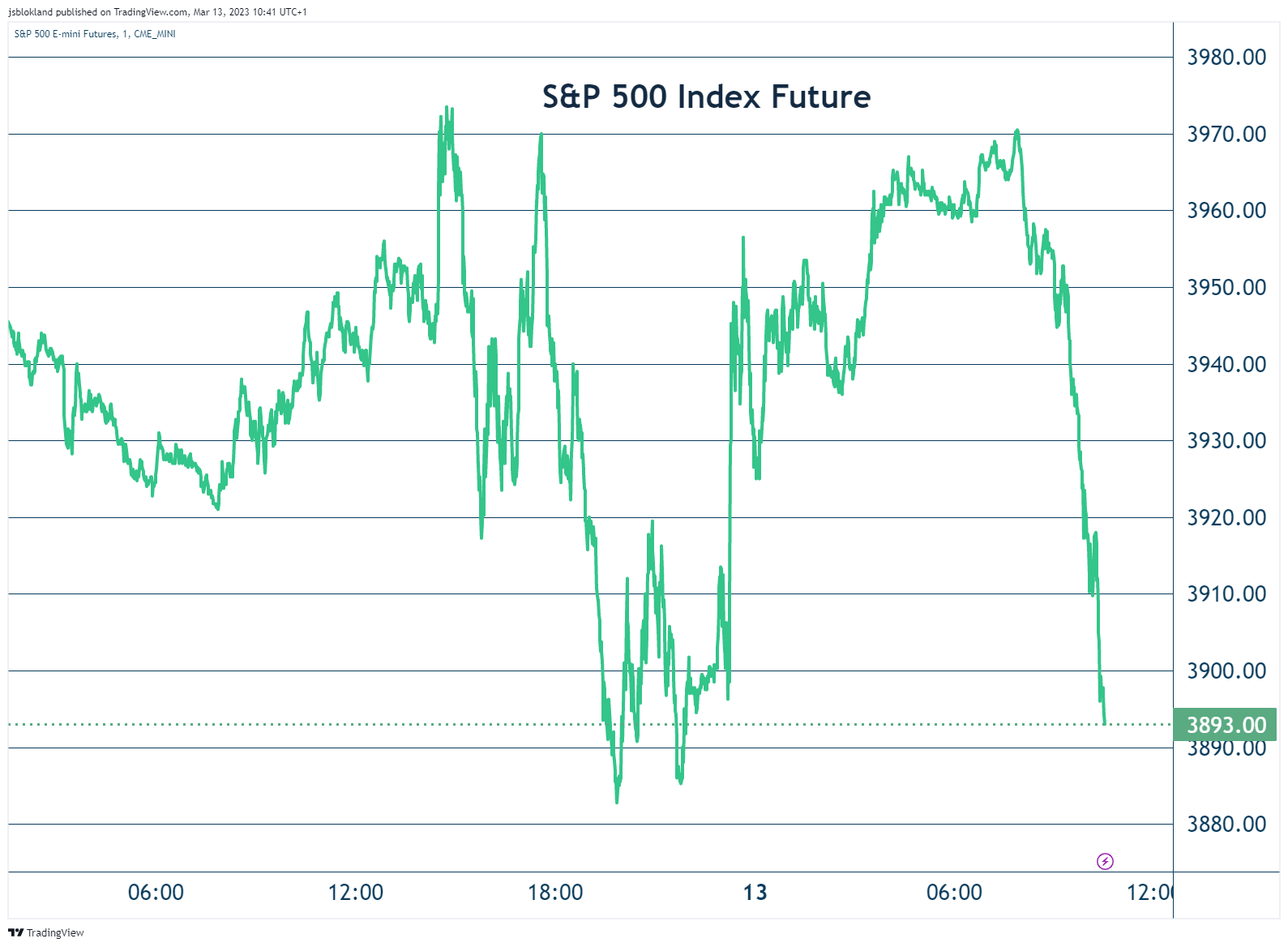

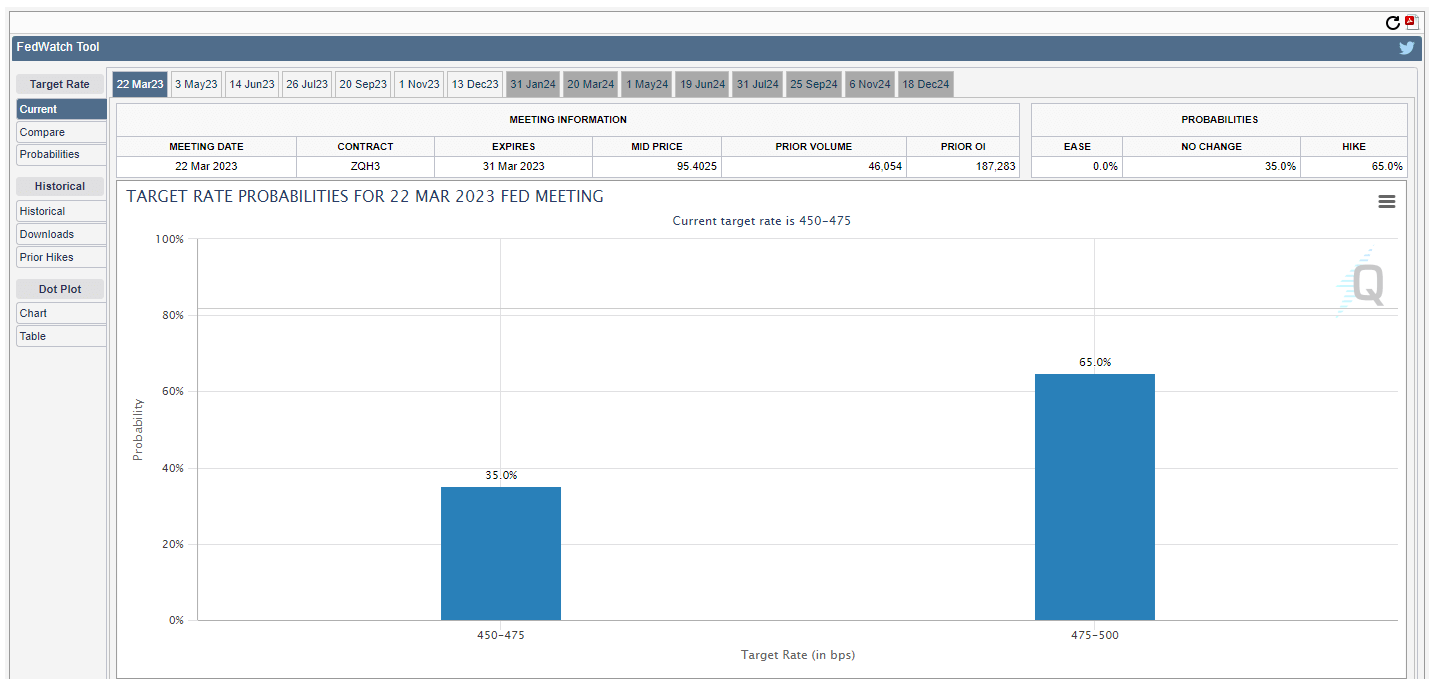

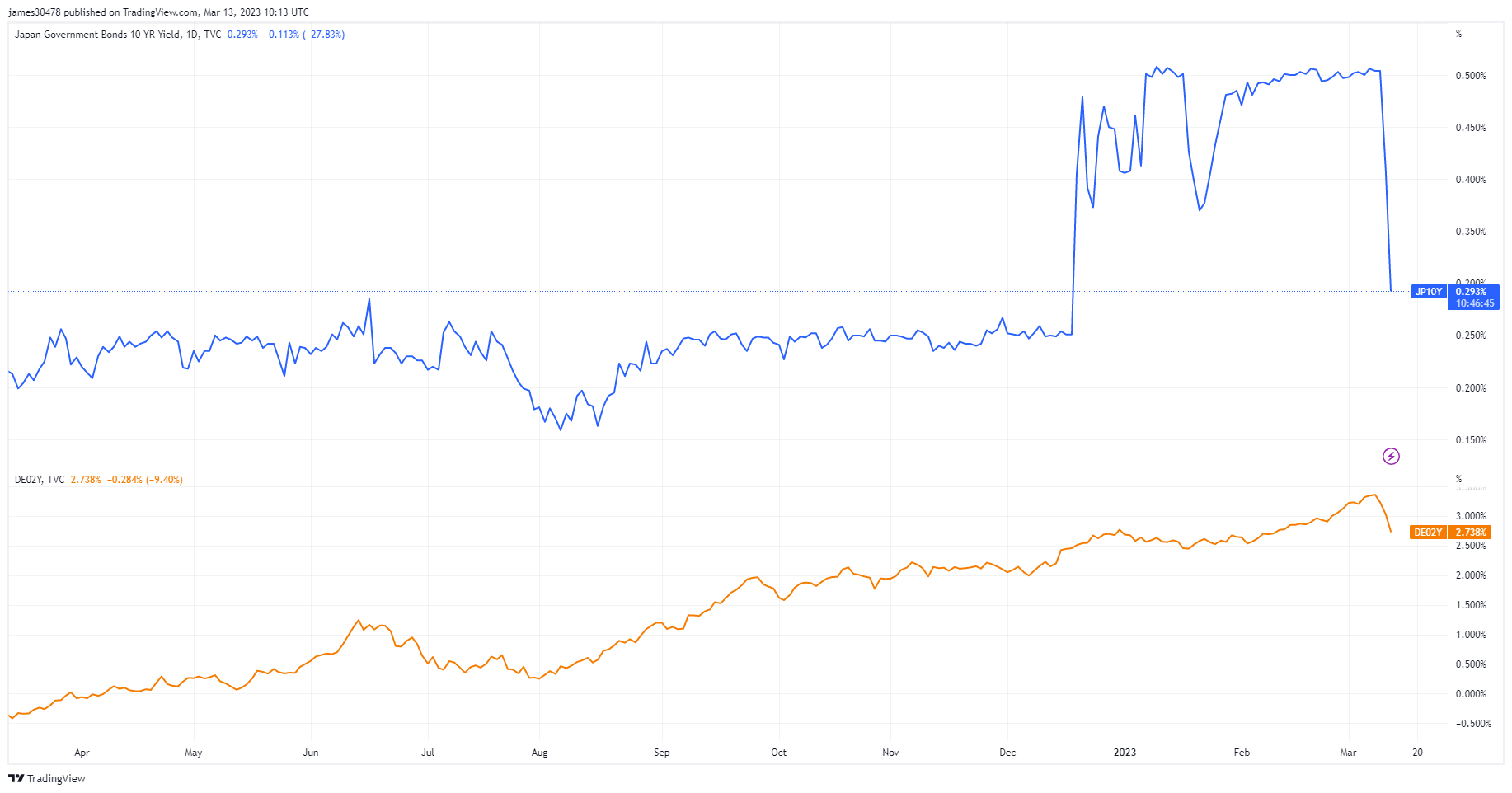

U.S. two-year yields set for the largest two-session drop since 1987, according to Zerohedge. Since last night, S&P futures have given up all their gains; contagion has further spread into the banking sector as Credit Suisse is down 10% to new lows, and the flight out to weak banks is just starting. Global bond yields have fallen worldwide; Japan’s 10-year yield dropped to 0.3% from 0.5% — while Germany’s two-year bond yield set for the largest drop on record. Markets believe U.S. central bank to raise just 25bps before cutting them later this year. The implied peak rate is down to 4.8% from an expected 5.7% S&P Futures: (Source: TradingView)

S&P Futures: (Source: TradingView)

Rate Hike: (Source: CME)

Rate Hike: (Source: CME)

Yields: (Source: Trading View)

Yields: (Source: Trading View)

The post Macro update: Markets think fed tightening is almost over with just one more 25 bps rise as Powell loses credibility appeared first on CryptoSlate.