MONEYVAL, Europe’s Anti-Money Laundering and Counter-Terrorism Financing (AML/CFT) watchdog, has prioritized monitoring the crypto industry, as well as “gatekeeper” professionals like attorneys and accountants, in European countries’ efforts to prevent money laundering.

Watchdog Says Europe Need Better AML Laws

MONEYVAL called on European countries to review conformity with international standards and develop tighter regulatory measures to combat money laundering enabled by crypto assets in a press release based on the findings of its annual study.

The Pandora Papers, according to Elbieta Frankow-Jakiewicz, chief of MONEVYAL, are an example of how experts functioning as “gatekeepers” can help the rich and corrupt launder their money. She also stated that the use of crypto assets for money laundering is becoming more popular:

“A newer money laundering trend is related to the emerging virtual assets sector, the increasing global use of cryptocurrencies, and other components of the rapidly evolving ecosystem of so-called “decentralized finance” (DeFi).”

Moneyval is a Council of Europe anti-money laundering (AML) oversight organization that spans 47 European states. The task group is in charge of examining and recommending policy changes that have an impact on national legislative reforms.

The research determined that among its monitored jurisdictions, the median level of compliance with the Financial Action Task Force (FATF) requirements falls below the satisfactory criterion. MONEYVAL found that eighteen of the twenty-two jurisdictions assessed were insufficiently compliant with AML regulations.

Later this year, the European watchdog will launch a separate research to look into money laundering patterns involving virtual assets.

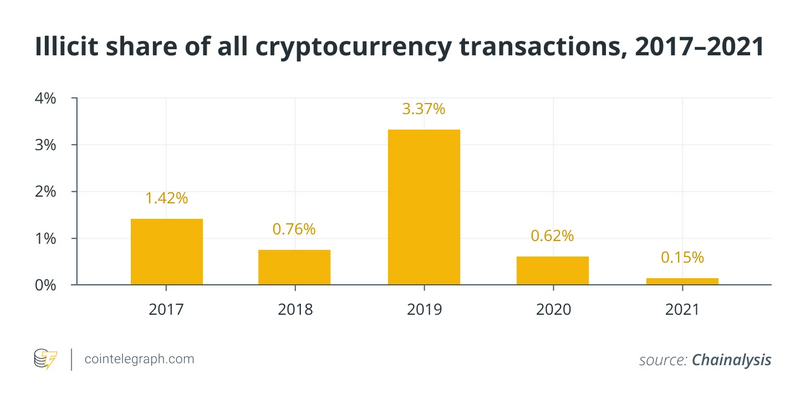

While regulators continue to express concern about the use of cryptocurrencies for money laundering and other illegal activities, the latest data from blockchain analysis firm Chainalysis suggests that less than 1% of the total circulating supply of cryptocurrency was used for illegal activities in 2021.

Related reading | Why The European Union Voted Against A De Facto Bitcoin Mining Ban

Europe Set For Crypto Regulation

Last week, talks between the European Union’s parliament, commission, and council began on contentious anti-money laundering rules for crypto transactions, the final step before the measures become law, which some fear will destroy privacy and hamper innovation.

Many in the industry question whether tough new rules are needed to combat a wave of criminal activity, but more pragmatic voices are looking at the legislative details that could prove crucial, such as how the law will treat small payments and unhosted wallets, as well as when the new law will take effect.

The proposed regulation would oblige crypto companies to check user information and report questionable transactions to authorities, but the industry has expressed concerns that it would be difficult to implement.

A last-minute complaint spearheaded by Coinbase (COIN) and other similar companies mostly went unheeded, and on March 31 European Parliament legislators decided to apply stringent money-laundering restrictions to the sector, stating that the rules were necessary to reduce crime. Now the focus is on what the law’s final form will be.

Both legislators in the European Parliament and national governments convening in the EU Council have expressed a desire for more stringent oversight of parties involved in crypto transactions. They argue that this should apply even to the smallest payments – unlike traditional bank transfers, which only require customer identification verification for transactions exceeding 1,000 euros ($1,066) – because it’s easier to avoid by splitting up digital payments into small bits.

Related Reading | How This Ethereum Mining Bypass For Nvidia GPUs Came On Sale

The new requirements, according to the Council, should be implemented once crypto licensing legislation takes effect, and only two years after the Markets in Crypto Assets Regulation is finalized. The MiCA law, which would allow crypto companies to operate across the EU if they met financial-stability and investor-protection standards, is also nearing completion.

Featured Image from Unsplash | Charts by TradingView